Welcome to our comprehensive guide on gutter industry statistics, filled with insights.

Whether you’re looking to understand market shifts, assess emerging opportunities, or fine-tune your business strategies, this page delivers valuable data and actionable takeaways to help you navigate the industry’s current state and the years ahead.

Below, you can explore the latest trends, consumer behaviors, and key growth areas shaping the gutter installation and maintenance landscape.

1. Gutter Market & Growth Trends

The gutter industry is evolving rapidly, driven by increasing homeowner awareness of water damage prevention and the growing demand for low-maintenance solutions. Property owners are seeking systems that protect their investments while reducing upkeep, pushing seamless gutters and gutter guard technology into the spotlight and opening substantial opportunities for new and recurring business.

Modernization is a top priority, with a balance between repairs, replacements, and new installations for both residential and commercial properties. The future of gutters hinges on innovation, durability, and meeting customers’ specific climate and architectural needs.

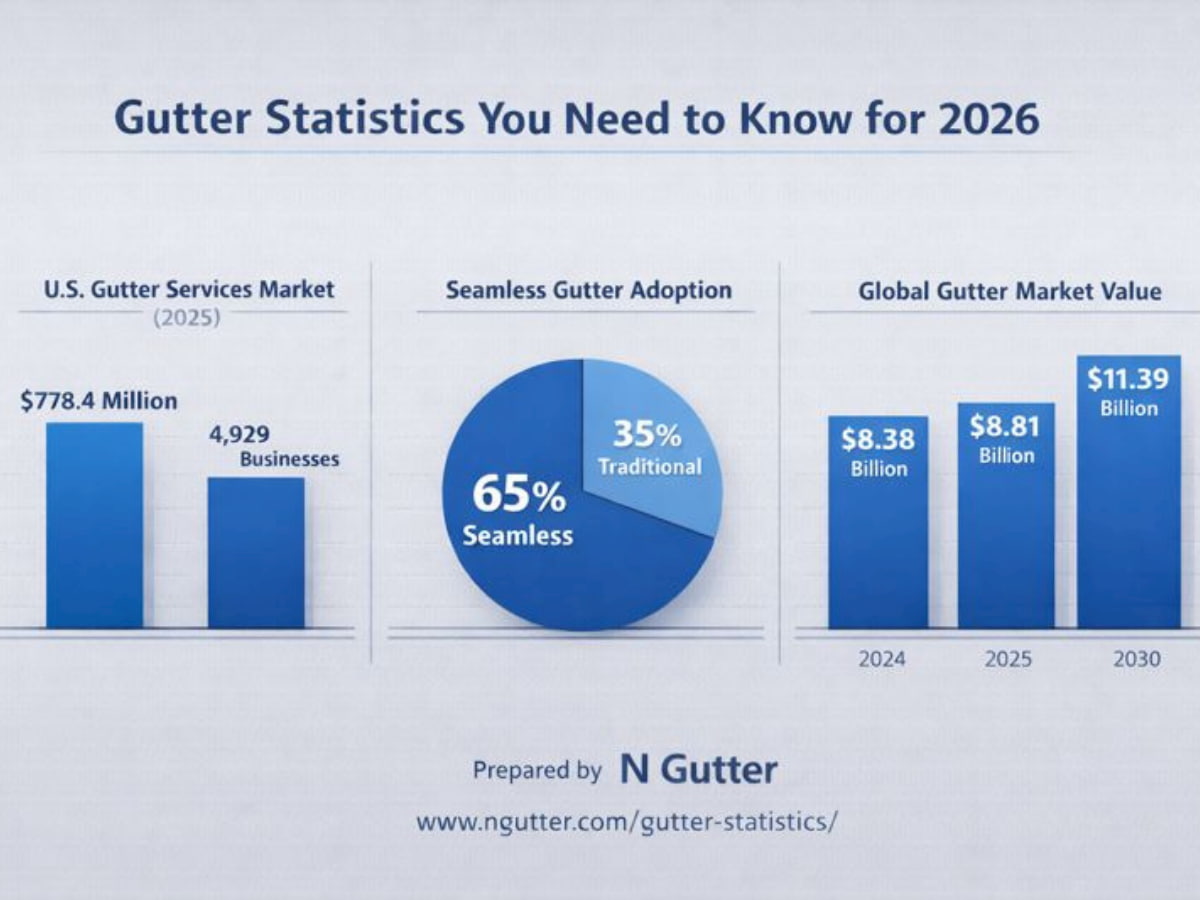

Market Size Growth: The U.S. gutter services industry generated $778.4 million in revenue in 2025, with 4,929 businesses operating in the sector. Source: IBISWorld

Global Market Value: The global rain gutter market grew from $8.38 billion in 2024 to $8.81 billion in 2025, expected to reach $11.39 billion by 2030 at a CAGR of 5.24%. Source: Yahoo Finance

Market Fragmentation: No single company holds more than 5% market share, indicating a highly competitive landscape for local contractors. Source: IBISWorld

Business Growth: The number of U.S. gutter service firms has grown at a CAGR of 3.9% between 2020-2025, reaching 4,929 businesses. Source: IBISWorld

Material Cost Pressure: Proposed tariffs on steel and aluminum imports have raised material costs, with over 90% of gutter products relying on these metals. Source: IBISWorld

Residential Market Share: Gutter installation services represent the largest revenue segment, followed by cleaning and repair services. Source: IBISWorld

Product Segmentation: Gutter services account for the largest portion of industry revenue, with drain services and repair as secondary segments. Source: IBISWorld

2. Gutter Material Innovation & System Lifespan

For gutter contractors, moving toward premium material solutions is no longer optional—it’s the standard for differentiation and profitability.

By educating homeowners about solutions like seamless aluminum, copper longevity, and advanced gutter guards, you position yourself as a trusted advisor, helping customers avoid costly water damage while improving their home’s protection. Proper installation is equally critical, as even high-quality materials fail without correct pitch and hanger spacing.

Seamless Technology Adoption: Seamless gutters reduce leak points by 80% compared to sectional systems, making them the preferred choice for 65% of new installations. Source: Fine Homebuilding

Average System Lifespan: Aluminum gutters last 20-30 years when properly maintained, while vinyl gutters last 10-15 years and copper gutters can exceed 50 years. Source: National Association of Home Builders

Material Cost Trends: Steel and aluminum coil prices have increased significantly since 2020 due to supply chain constraints and tariff impacts, affecting contractor margins. Source: IBISWorld

Foundation Protection Impact: Properly functioning gutters reduce basement moisture issues by 76%, preventing average repair costs exceeding $8,000. Source: American Society of Home Inspectors

Technical Standards: SMACNA’s Architectural Sheet Metal Manual provides industry-standard methods for sizing gutters and downspouts based on roof area and rainfall intensity. Source: SMACNA

Weather Resilience: Modern gutter systems incorporate UV-resistant and impact-resistant materials to withstand extreme weather conditions, a key selling point in storm-prone regions. Source: Yahoo Finance

Installation Precision: Improperly pitched gutters fail to capture 40% of roof runoff during heavy rainfall events, emphasizing the need for professional installation. Source: Fine Homebuilding

ROI on Premium Materials: Premium gutter system upgrades provide a 70% return on investment at resale, according to real estate professionals. Source: Remodeling Magazine

3. Gutter Water Management & Efficiency

Increasing storm intensity makes efficient water management systems more critical than ever for property protection. Gutter contractors play a vital role in helping clients understand the long-term financial and structural benefits of properly sized and positioned systems, and the risks of inadequate drainage.

Extreme Precipitation Increase: Climate data shows a 27% increase in extreme precipitation events since 1990, driving demand for higher-capacity gutter systems. Source: NOAA

Water Damage Prevalence: Over 50% of residential water damage claims originate from improper exterior water management, with gutters being a primary failure point. Source: Insurance Information Institute

Ice Dam Prevention: Properly maintained gutters reduce ice dam formation by 60% when combined with adequate attic insulation and ventilation. Source: Insurance Institute for Business & Home Safety

Foundation Protection: Effective gutter systems divert approximately 1,000 gallons of water away from foundations for every inch of rainfall on a 2,000 sq ft roof. Source: University of Minnesota Extension

Erosion Control: Homes without gutters experience 5x more soil erosion around foundations, compromising landscaping and structural stability. Source: American Society of Landscape Architects

Rainwater Harvesting: Homes with rain barrel systems connected to gutters can reduce outdoor water usage by 40%, saving an average of $180 annually on utility bills. Source: Environmental Protection Agency

Downspout Efficiency: Installing one downspout per 20-30 linear feet of gutter improves drainage efficiency by 35% and prevents overflow during heavy rains. Source: Sheet Metal & Air Conditioning Contractors Association

4. Gutter Maintenance & Service Statistics

Routine maintenance dramatically extends gutter system longevity and prevents catastrophic failures.

Contractors who emphasize proactive care help clients avoid costly water damage repairs and maximize system performance. For commercial properties, regular servicing minimizes liability and ensures code compliance.

Cleaning Cost Range: The average gutter cleaning service costs $167, with most homeowners spending between $119 and $234, or $0.95 to $2.25 per linear foot. Source: Angi

Annual Industry Spend: Americans collectively spend $1.2 billion annually on professional gutter cleaning and maintenance services. Source: Data Insights Market

Maintenance ROI: Professional gutter maintenance costs $100-$300 annually, while the average water damage claim from gutter neglect ranges from $11,605 to $14,000. Source: Flow Shield Guards

Emergency Repair Costs: Basement flooding repairs average $4,300, with most homeowners spending $1,600-$6,900 due to gutter failure. Source: Forbes Home via Flow Shield Guards

Cleaning Frequency Impact: Only 25% of homeowners clean gutters the recommended twice annually, leading to a 300% higher failure rate in unmaintained systems. Source: National Association of Realtors

Seasonal Demand: 65% of gutter service calls occur during fall and spring, creating predictable seasonal business cycles. Source: Gutter Contractor Association

Commercial Compliance: Commercial properties with quarterly gutter inspections experience 80% fewer water-related insurance claims than annual-only inspections. Source: Building Owners & Managers Association

Gutter Guard Adoption: 30% of new gutter installations now include gutter guards, reducing maintenance callbacks by 45% for contractors. Source: Qualified Remodeler Magazine

Service Frequency: Homes with gutter guards or screens can reduce cleaning frequency to once annually, even in heavily treed areas. Source: Angi

5. Gutter Industry Statistics

The gutter industry faces significant challenges, from escalating material costs to workforce constraints and increasing competition from national franchises. Contractors who adapt by leveraging digital estimating tools and operational software can improve efficiency and meet escalating customer expectations for faster, cleaner installations.

Workforce Constraints: The exterior services industry faces a labor shortage, with 58% of contractors citing it as a challenge hindering growth and profitability in 2025. Source: ServiceTitan

Material Price Increases: 64% of exterior contractors report increasing material prices as a primary concern, with equipment prices rising significantly since 2020. Source: ServiceTitan

Business Optimization: 62% of exterior contractors are pursuing strategies to optimize overhead costs, while 56% focus on reducing labor costs and 37% on improving marketing efficiency. Source: ServiceTitan

Revenue Growth Focus: 76% of exterior contractors seek to grow revenue in 2025, though only 56% expect to achieve it given current challenges. Source: ServiceTitan

Technology Adoption: Contractors using digital measurement tools reduce installation time by 30% and material waste by 15% compared to traditional methods. Source: ForConstructionPros

Customer Acquisition Cost: The average cost to acquire a new gutter customer through digital marketing continues to rise year-over-year, requiring more efficient marketing strategies. Source: ServiceTitan

Startup Investment: The average gutter contractor invests $45,000-$65,000 in seamless gutter machines, vehicles, and initial inventory to start operations. Source: Upperinc

Industry Fragmentation: The gutter services market is highly fragmented with low concentration, providing opportunities for specialized local providers. Source: IBISWorld

6. Gutter Contractor Workforce Statistics

The gutter installation workforce is mature and stable, with opportunities concentrated in private residential construction. While job growth remains steady, filling roles with reliable professionals requires a focus on safety training and retention.

Workforce Demographics: There are approximately 123,840 roofing contractors (including gutter specialists) currently employed in the United States. Source: U.S. Bureau of Labor Statistics

Hourly Wages: Roofing contractors (including gutter installers) earn a median wage of $26.72 per hour, with experienced seamless installers commanding $28-$35 hourly. Source: U.S. Bureau of Labor Statistics

Gender Distribution: Only 5.0% of gutter installers are women, while 95.0% are men, highlighting the need for greater diversity and inclusion initiatives. Source: Zippia

Private Sector Focus: The vast majority of gutter contractors work for privately held companies in the foundation, structure, and building exterior contractors sector. Source: U.S. Bureau of Labor Statistics

Age Distribution: The construction workforce averages 40 years old, with 35% of the workforce aged 45-65, indicating upcoming retirement-driven turnover. Source: U.S. Bureau of Labor Statistics

Training ROI: Companies investing in employee training see 218% higher income per employee and 24% higher profit margins. Source: PeopleGoal

Worker Retention: 94% of workers are more likely to stay with companies that invest in training and development programs. Source: PeopleGoal

Safety Certification: Contractors with OSHA-10 certification experience 65% fewer workplace injuries, reducing workers’ compensation costs. Source: Occupational Safety & Health Administration

7. Gutter Consumer Insights

When it comes to choosing gutter services, consumers increasingly prioritize factors beyond upfront cost. System reliability, warranty coverage, and contractor reputation heavily influence purchasing decisions. Homeowners want to know their gutter investment will protect their most valuable asset without constant attention.

Review Reliance: 91% of consumers rely on online reviews when selecting home service contractors, with 73% requiring a 4-star rating minimum. Source: BrightLocal

Trust in Referrals: 89% of people most trust recommendations from people they know, making referrals the highest-converting lead source. Source: Marketing News Canada

Maintenance Avoidance: 82% of homeowners indicate they would pay 25-40% more for gutter systems requiring minimal maintenance. Source: Qualified Remodeler

Warranty Priority: Warranty coverage ranks as a top priority for homeowners choosing gutter systems, above material selection. Source: GuildQuality

Purchase Timing: 78% of homeowners contact gutter contractors only after observing visible problems, missing preventative opportunities. Source: Consumer Reports

Brand Recognition: Only 15% of homeowners can name a gutter manufacturer brand, indicating contractor reputation matters more than product branding. Source: Hanley Wood

Cost Transparency: Consumers demand detailed explanations of water flow capacity and material specifications during estimates. Source: Angi

Referral Power: 74% of satisfied gutter customers refer friends and family within two years, generating the highest quality leads. Source: Nielsen

The Future of Gutters

The gutter industry is transforming from a commoditized trade into a specialized water management solution, presenting numerous opportunities for contractors who adapt to shifting customer expectations and climate challenges.

By prioritizing premium materials, proactive maintenance, and customer education, you can differentiate your business and build long-term success.

The data clearly shows that homeowners are willing to invest more in systems that protect their property and reduce maintenance burden.

Contractors who position themselves as water management experts rather than just installers will capture the premium segment of this growing market. Technology adoption, workforce development, and reputation management will separate thriving businesses from those struggling with price competition.

As extreme weather events become more frequent and insurance companies increasingly require documented maintenance, the gutter industry will see continued growth in protection systems and service contracts. Now is the time to leverage these statistics to inform your business strategy and capture your share of this expanding market.